You may be wondering why I am choosing to answer this question when this is something business owners should know. Unfortunately, while 1099s are a significant part of tax reporting requirements, it is surprising how many business owners aren’t aware of what it is and how to process it. This article attempts to define 1099, its purpose, requirements and consequences associated with non-compliance.

WHAT IS A 1099?

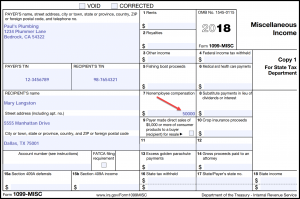

Form 1099 was brought to life by the Internal Revenue Service (IRS) in 1918 and over the decades has morphed into various versions. For the purpose of this article, we’ll focus on the 1099-Misc (Miscellaneous).The IRS refers to 1099s as “information returns”. Simply put, it’s another way for the IRS to track our taxable income.

As small business owners, we all need help from others outside of our employees, such as bookkeeping services, subcontractors, cleaning services, IT support, marketing consultants, etc. The 1099-Misc is the form the IRS have us use to report these payments. Keep in mind however, that while this is the most common use of 1099s for small businesses like ours, the 1099-Misc covers many other forms of miscellaneous income.

WHO GETS THE 1099-MISC?

File Form 1099-MISC should be issued for each person to whom you have paid during the year:

- at least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest;

- at least $600 in:

- rents;

- services performed by someone who is not your employee;

- prizes and awards;

- other income payments;

- medical and health care payments;

- crop insurance proceeds;

- cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish;

- generally, the cash paid from a notional principal contract to an individual, partnership, or estate;

- payments to an attorney; or

- any fishing boat proceeds,

In addition, use this form to report that you made direct sales of at least $5,000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment (Box 9).

You also must file Form 1099-MISC for each person from whom you have withheld any federal income tax under the backup withholding rules regardless of the amount of the payment.

(See below for what a 1099-Misc Form looks like)

Exceptions to 1099-MISC Requirement

Here are some general exceptions to the requirement that you must issue a 1099-MISC:

- You do not generally send 1099-Misc to a corporation (including a limited liability company (LLC) that is treated as a C or S corporation).

- Additional exceptions are payments of wages/ salaries to employees and payments for business travel to employees,

- payments for rent to rental agencies,

- payments for merchandise, telephone, storage and similar items.

These exceptions are more complicated than indicated here, and there are exceptions-to-the-exceptions. Please be sure to contact your tax professional before deciding not to send someone a request for a W-9. It is usually best to err on the side of sending one out and then discovering that it was not necessary to do so.

TIP :

Before you make payments to any entity or individual (not included in the exemptions), have them complete a Form W-9 so that you’ll have the information you need to complete a 1099-Misc when these are due.

While you as an entity might be exempt from receiving a 1099 you are certainly not exempt from sending them out. There is a common misconception that if the vendor you work with is not an individual but is a company that is setup as a disregarded entity, you do not have to send them a 1099.

WHEN IS IT DUE?

The 1099-MISC due dates are two-fold – due date to the recipients and due dates to file with the IRS.

1099-MISC should be correctly completed and be in the hands of the recipient no later than January 31st of each year.

1099-MISC filing for the IRS if filing via paper must be post marked by January 31st and if being filed electronically must be submitted to the IRS by January 31st.

NOTE: It is highly recommended that you keep mailing times in mind when issuing 1099s.

TIP:

Companies that need more time to file 1099s, can send the IRS form 8809 to apply for an extension

PENALTIES

Not filing 1099-MISC, making errors or submitting them late could result in harsh penalties. These fines begin at $30 per return and can go up to amounts exceeding a million dollars.

Furthermore you can have expenses disallowed on your tax return because of failure to issue 1099s to those qualifying individuals or entities. Please ensure your 1099-Misc is completed correctly and on time.

Wouldn’t it be great if you never have to wonder about 1099-Misc and whether you are in compliance with IRS requirements? Clients of A Bookkeeper 4 U do not have this worry.

If you have questions or need help staying complaint with 1099 requirements please contact our office at (570) 839-3922 or visit our website at www.abk4u.com

See this link for more details on penalties: https://www.irs.gov/government-entities/federal-state-local-governments/increase-in-information-return-penalties-2

Here’s a link to IRS’ official guide to assist you with completing & filing the 1099-MISC: https://www.irs.gov/pub/irs-pdf/i1099msc.pdf.